Fruitas reports best quarter since listing – delivers Php168 million of shareholder value in 2Q2022

2Q2022 net income of Php23 million is 3.3x 2Q2021 net income

Fruitas records Php145 million in incremental equity reserves from BALAI listing

2Q2022 Highlights:

- 2Q2022 net income of Php23 million – 3.3x 2Q2021 net income of Php7 million

- Php145 million excess value over cost of investments recorded as part of equity reserves from listing of BALAI shares on June 30, 2022

- 2Q2022 revenue of Php457 million – 1.74x 2Q2021 revenue of Php263 million

1H2022 Highlights:

- 1H2022 net income of Php29 million – significant reversal of Php9 million net loss in 1H2021

- 1H2022 revenue of Php787 million – 1.5x 1H2021 revenue of Php524 million

Leading food and beverage small footprint store operator, Fruitas Holdings Inc., listed on the Philippine Stock Exchange under the symbol FRUIT, delivered Php168 million of shareholder value in second quarter of 2022. This comprised Php23 million of quarterly net income – its best reported net income since listing – and Php145 million in incremental equity reserves from the listing of Balai ni Fruitas (BALAI) shares. The incremental equity reserves represent excess value over cost of investments as FRUIT was able to price the BALAI shares at a significant premium to its investment during the IPO.

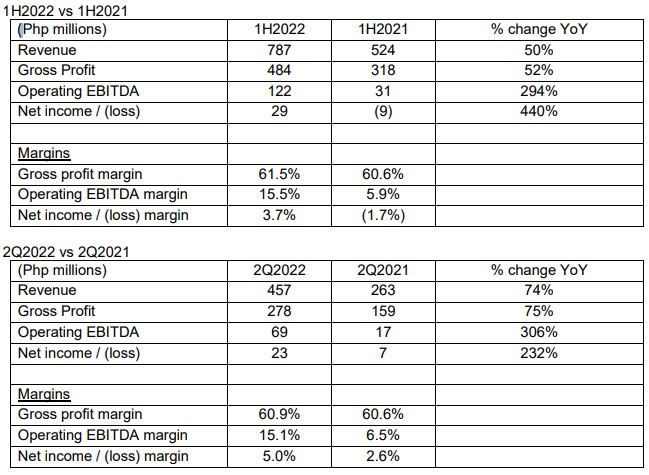

FRUIT posted a consolidated Php23 million of net income and Php457 million of revenues in the second quarter of 2022. 2Q2022 net income is 3.3x the net income of Php7 million in 2Q2021 and 1.74x the revenues of Php263 million in 2Q2021. On a quarter-by-quarter basis, 2Q2022 net income was 3.6x 1Q2022 net income of Php6.4m and 2Q2022 revenues was 1.4x 1Q2022 revenues of Php330 million.

For 1H2022, consolidated net income of Php29 million was a significant reversal of Php9 million net loss in 1H2021. 1H2022 revenues of Php787 million is 1.5x 1H2021 revenues of Php524 million.

For 1H2022, FRUIT posted a gross margin at 61.5%, which is better than the 60.6% gross margin in 1H2021 despite the increasing raw material prices. The Group has implemented tactical price increases and continued to expand its supplier base and improved raw material sourcing to mitigate raw material price increases. For 1H2022, FRUIT registered EBITDA of Php122 million. 1H2022 EBITDA margin reached 15.5%, better than the 5.9% margin recorded in 1H2021, as the Group continued to capitalize on economies of scale and improved store performance. Net margin for 1H2022 was at 3.7%, compared to negative 1.7% in 1H2021. Net margin continued to expand in 2Q2022 at 5.0% versus 1.8% in 1Q2022.

Compared to pre-pandemic levels, store sales in May 2022 already reached 96% of May 2019 level and June 2022 store sales already reached 97% of June 2019. This was achieved despite having significantly less stores compared to pre-pandemic levels, which translates to a much higher average daily sales per store and better store economics.

FRUIT’s consolidated cash and cash equivalents has also increased to Php610 million from Php318 million primarily driven by the proceeds from the BALAI IPO, completed on June 30, 2022. FRUIT had increased its liquidity from a 2.4x current ratio at the end of 2021 to 3.0x as of June 30, 2022, thus providing the Group more flexibility to execute its strategic initiatives which include its store network expansion and potential acquisitions. Debt-to-equity ratio dropped from 34.3% at the end of 2021 to 28.7% as of June 30, 2022.

In terms of subsidiaries, BALAI registered the most significant growth in net income from Php2 million in 2Q2021 to Php9 million 2Q2022. FRUIT’s beverage and food subsidiaries, Fruitasgroup and Negril Trading, respectively, likewise delivered stellar quarters. Fruitas group benefited from the seasonal bump in demand for its juices and shakes during the summer season, while Negril Trading benefited from reopening of cinemas, with its anchor product de Original Jamaican Pattie, being a go-to snack for cinema lovers.

Soykingdom Inc., another FRUIT subsidiary, is set to complete the acquisition of the Ling Nam business within August of 2022. The acquisition shall include various assets of Ling Nam including its trademark and technical know-how, among others. The acquisition will be FRUIT’s entry into the casual dining segment and will complement Soy & Bean to solidify its expansion in Asian food concepts.

FRUIT added about 20 stores from March to July 2022, boosting its number of stores to above 720. The recent IPO of BALAI allows the Group to further expand its network more aggressively. The Balai Pandesal commissary is expected to start operations within 3Q2022.

“The 2022 first half performance is a testament of the Group’s ability to deliver significant value to its shareholders. Despite economic headwinds, we delivered increasing margins and profits. We continue to bring focus to each of our subsidiaries in line with our vision of each Filipino household consuming a Fruitas product everyday. Our performance for July 2022 also continued to exceed our expectations and we hope to deliver a bumper year to our shareholders,” said Mr. Lester Yu, FRUIT President and Chief Executive Officer.

The foregoing disclosure contains forward-looking statements that are based on certain assumptions of Management and are subject to risks and opportunities or unforeseen events.

Actual results could differ materially from those contemplated in the relevant forward-looking statement and FRUIT gives no assurance that such forward-looking statements will prove to be correct or that such intentions will not change. This Press Release discloses important factors that could cause actual results to differ materially from FRUIT’s expectations. All subsequent written and oral forward-looking statements attributable to the FRUIT or persons acting on behalf of the Group are expressly qualified in their entirety by the above cautionary statements.